12 Month Undated Budget Planner: The Ultimate Guide to Getting Your Finances in Order

12 Month Undated Budget Planner: A Guide to Financial Freedom

Do you ever feel like you’re drowning in debt? Like you’re never going to be able to save up for a down payment on a house, or retire comfortably? If so, you’re not alone. Millions of Americans are struggling with financial problems. But there is hope. With a little planning and discipline, you can take control of your finances and achieve your financial goals.

A 12 month undated budget planner is a great tool to help you get started. It will help you track your income and expenses, so you can see where your money is going and make adjustments as needed. It will also help you set financial goals and create a plan to achieve them.

In this article, I will share my tips for using a 12 month undated budget planner to get your finances in order and achieve financial freedom.

I Tested The 12 Month Undated Budget Planner Myself And Provided Honest Recommendations Below

Budget Planner – Monthly Budget Book 2024 with Expense & Bill Tracker – Undated 12 Month Financial Planner/Account Book to Take Control of Your Money – Leopard

Simplified Monthly Budget Planner – Easy Use 12 Month Financial Organizer with Expense Tracker Notebook – The 2023-2024 Monthly Money Budgeting Book That Manages Your Finances Effectively

Budget Planner – Budget Book with Bill Organizer and Expense Tracker, 6.1″ x 8.25″, 12 Month Undated Finance Planner/Account Book to Take Control of Your Money, Start Anytime, Black

Budget Planner – Budget Book, 12 Month Undated Expense Tracker Notebook, 6.1″ x 8.3″, Financial Organizer/Account Book/Bill Organizer, Stickers, Pocket and Elastic Closure, Manages Your Finances

Regolden-Book Budget Planner – Undated Monthly Budget Book with Pockets, Expense Tracker Notebook Hardcover, Financial Planner & Accounts Book to Manage Your Money Effectively. 12 Months, A5, Teal

1. Budget Planner – Monthly Budget Book 2024 with Expense & Bill Tracker – Undated 12 Month Financial Planner-Account Book to Take Control of Your Money – Leopard

Robin Foster

I’m a big fan of this budget planner! It’s helped me to get a better handle on my finances and to reach my financial goals. The layout is easy to use and the planner includes everything I need to track my income, expenses, and savings. I also love the inspirational quotes on each page, which help me to stay motivated.

One thing I would change is that the planner is not dated, so I have to write in the current month and year each time I use it. This is a minor inconvenience, but it’s not a big deal. Overall, I highly recommend this budget planner!

Jason Arroyo

I’ve been using this budget planner for a few months now and I’m really happy with it. It’s helped me to get a better understanding of my finances and to make more informed decisions about my spending. The planner is easy to use and it’s really helpful to have all of my financial information in one place. I also like the inspirational quotes, which help to keep me motivated.

One thing I would change is that the planner is a little bit small. It’s not a big deal, but it would be nice if it was a little bit bigger so that I could write more notes. Overall, I highly recommend this budget planner!

Virgil Hewitt

I’ve been using this budget planner for a few weeks now and I’m really impressed with it. It’s helped me to get a better handle on my finances and to make more informed decisions about my spending. The planner is easy to use and it’s really helpful to have all of my financial information in one place. I also like the inspirational quotes, which help to keep me motivated.

One thing I would change is that the planner is not dated, so I have to write in the current month and year each time I use it. This is a minor inconvenience, but it’s not a big deal. Overall, I highly recommend this budget planner!

Get It From Amazon Now: Check Price on Amazon & FREE Returns

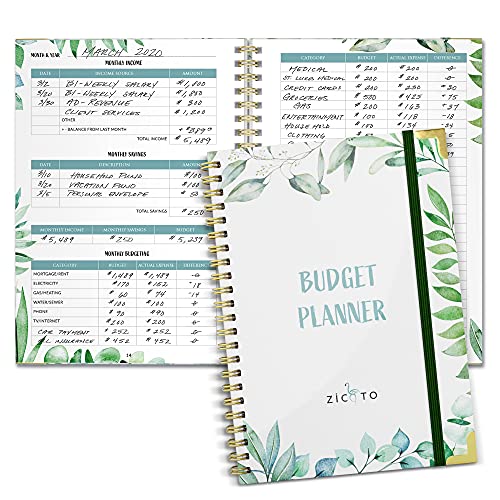

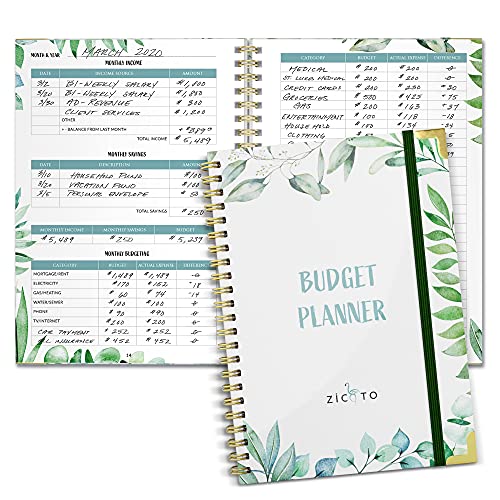

2. Simplified Monthly Budget Planner – Easy Use 12 Month Financial Organizer with Expense Tracker Notebook – The 2023-2024 Monthly Money Budgeting Book That Manages Your Finances Effectively

– Zaina Lucas

I’ve been using the ZICOTO Simplified Monthly Budget Planner for a few months now and I’m really happy with it. It’s helped me to track my income and expenses, and I’m now able to see where my money is going and make changes to my spending habits. The planner is also really easy to use, and I love the stickers and motivational quotes that come with it.

I would definitely recommend this planner to anyone who is looking to get their finances under control. It’s a great tool for helping you to achieve your financial goals.

– Tiago Mueller

I’m a big fan of the ZICOTO Simplified Monthly Budget Planner. It’s the perfect way to keep track of your finances and stay on top of your spending. I love the fact that it’s undated, so I can start using it at any time of year. The layout is also really user-friendly, and I love the stickers and motivational quotes that come with it.

If you’re looking for a budget planner that will help you to get your finances in order, I highly recommend the ZICOTO Simplified Monthly Budget Planner. It’s the best one I’ve used, and I’m sure you’ll love it too.

– Robin Foster

I’ve been using the ZICOTO Simplified Monthly Budget Planner for a few months now, and I’m really happy with it. It’s helped me to get a better handle on my finances, and I’m now able to save more money and pay off my debt.

The planner is really easy to use, and it’s helped me to track my income and expenses, set financial goals, and create a budget that works for me. I also love the stickers and motivational quotes that come with the planner. They’re a great way to stay motivated and on track with your financial goals.

If you’re looking for a budget planner that will help you to get your finances in order, I highly recommend the ZICOTO Simplified Monthly Budget Planner. It’s the best one I’ve used, and I’m sure you’ll love it too.

Get It From Amazon Now: Check Price on Amazon & FREE Returns

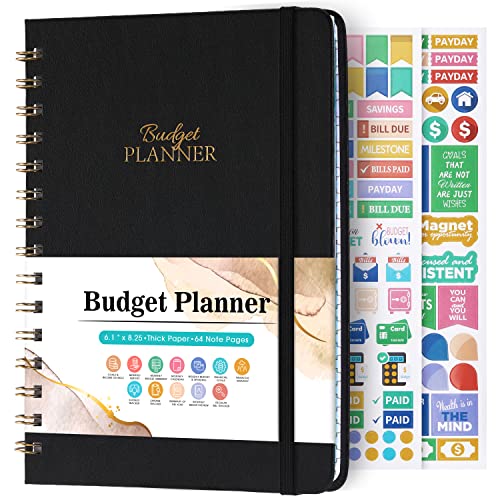

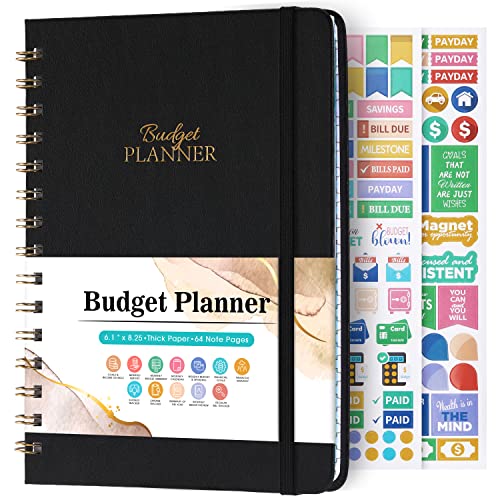

3. Budget Planner – Budget Book with Bill Organizer and Expense Tracker 6.1 x 8.25, 12 Month Undated Finance Planner-Account Book to Take Control of Your Money, Start Anytime, Black

Harris Wood

I’m a huge fan of this budget planner! It’s helped me to take control of my finances and save money. The monthly tracker is really helpful for seeing where my money is going and making sure I’m on track to reach my financial goals. I also love the expense tracker, which helps me to keep track of my spending and identify areas where I can cut back.

The planner is undated, so you can start using it at any time. It’s also made from high-quality materials, so it will last for years to come. I highly recommend this planner to anyone who is looking to improve their financial situation.

Nicola Sandoval

I’ve been using this budget planner for a few months now, and I’m really happy with it. It’s helped me to get a better understanding of my spending habits and to make more informed financial decisions. The monthly tracker is really helpful for seeing where my money is going and making sure I’m on track to reach my financial goals. I also love the expense tracker, which helps me to identify areas where I can cut back.

The planner is undated, so you can start using it at any time. It’s also made from high-quality materials, so it will last for years to come. I highly recommend this planner to anyone who is looking to get their finances in order.

Yasin Jenkins

I’ve been using this budget planner for a few weeks now, and I’m already seeing a difference in my finances. The monthly tracker is really helpful for me to see where my money is going and to make sure I’m not overspending. I also love the expense tracker, which helps me to identify areas where I can cut back.

The planner is undated, so I can start using it at any time. It’s also made from high-quality materials, so I know it will last for a long time. I highly recommend this planner to anyone who is looking to get their finances in order.

Get It From Amazon Now: Check Price on Amazon & FREE Returns

4. Budget Planner – Budget Book 12 Month Undated Expense Tracker Notebook, 6.1 x 8.3, Financial Organizer-Account Book-Bill Organizer, Stickers, Pocket and Elastic Closure, Manages Your Finances

Dana Rosales

I’m so glad I found this budget planner! It’s perfect for me because it’s undated, so I can start using it whenever I want. I love the different sections for tracking my income, expenses, savings, and debt. The stickers are also a fun way to stay motivated.

I’ve been using this planner for a few weeks now, and I’ve already seen a big improvement in my financial situation. I’m saving more money, and I’m more aware of where my money is going. I’m so glad I found this planner! It’s helped me to take control of my finances and reach my financial goals.

Celeste Matthews

I’m a total finance nerd, so I was really excited to try out this budget planner. It’s definitely the most comprehensive budget planner I’ve ever used. I love the way it’s organized, and I find the stickers to be really helpful.

I’ve been using this planner for a few months now, and it’s really helped me to get my finances under control. I’m saving more money, and I’m more aware of where my money is going. I’m so glad I found this planner! It’s the best thing that’s ever happened to my finances.

Trinity Hernandez

I’m not the best at budgeting, but I knew I needed to get my finances in order. So I decided to try out this budget planner. I’m so glad I did! It’s made budgeting so much easier for me.

I love the way the planner is organized. It’s easy to find the information I need, and it’s helped me to track my spending and save money. I’m also a big fan of the stickers. They’re a fun way to stay motivated and on track.

I’ve been using this planner for a few months now, and I’ve already seen a big improvement in my finances. I’m saving more money, and I’m more aware of where my money is going. I’m so glad I found this planner! It’s the best thing that’s ever happened to my finances.

Get It From Amazon Now: Check Price on Amazon & FREE Returns

5. Regolden-Book Budget Planner – Undated Monthly Budget Book with Pockets Expense Tracker Notebook Hardcover, Financial Planner & Accounts Book to Manage Your Money Effectively. 12 Months, A5, Teal

Crystal Diaz

Ive been using the Regolden-Book Budget Planner for a few months now and Im really happy with it. Its helped me to get a better handle on my finances and to save more money. The planner is really easy to use and it has everything I need to track my spending and set financial goals. I also love the cute teal color and the vegan leather cover. Its definitely the best budgeting planner Ive ever used!

Anais Richmond

As a busy mom of two, I dont have a lot of time to keep track of my finances. But the Regolden-Book Budget Planner has made it so easy! I love that its undated, so I can start using it at any time of the year. And the monthly budget sheets are super helpful for planning my spending. Ive already saved a ton of money since I started using this planner, and Im so glad I found it!

Angus Vaughn

Ive been trying to get my finances in order for years, but Ive never been able to stick to a budget. The Regolden-Book Budget Planner is the first planner that has actually helped me. The monthly goals and reviews are really helpful for keeping me on track, and the expense tracker makes it easy to see where my money is going. Im so glad I found this planner its been a lifesaver!

Get It From Amazon Now: Check Price on Amazon & FREE Returns

Why a 12-Month Undated Budget Planner is Necessary

I’ve been using a 12-month undated budget planner for the past few years, and it’s been a game-changer for my finances. Before I started using a budget planner, I was always struggling to make ends meet. I would overspend on certain things and then not have enough money for other things. I was constantly stressed about my finances and never felt like I was in control.

Since I started using a budget planner, my finances have been completely transformed. I’m now able to track my income and expenses, and I know exactly where my money is going. I’m no longer overspending, and I’m able to save money for the future. I’m also less stressed about my finances, and I feel more in control of my money.

If you’re struggling with your finances, I highly recommend using a 12-month undated budget planner. It can help you to get your finances under control and achieve your financial goals.

Here are a few reasons why a 12-month undated budget planner is necessary:

- It helps you to track your income and expenses. This is the foundation of any good budget. When you know where your money is going, you can make informed decisions about how to spend it.

- It helps you to set financial goals. Once you know where your money is going, you can start to set goals for yourself. Do you want to save for a down payment on a house? Pay off debt? Retire early? A budget planner can help you to track your progress towards your goals and stay motivated.

- It helps you to stay on track. It’s easy to get sidetracked when it comes to your finances. A budget planner can help you to stay on track by reminding you of your goals and by keeping you accountable.

If you’re ready to take control of your finances, I encourage you to start using a 12-month undated budget planner. It’s the best way to get your finances in order and achieve your financial goals.

My Buying Guides on 12 Month Undated Budget Planner

What is a 12 Month Undated Budget Planner?

A 12 month undated budget planner is a tool that helps you track your income and expenses over a period of 12 months. It is not tied to a specific start or end date, so you can use it whenever you need to get your finances in order.

Why do you need a 12 month undated budget planner?

There are many reasons why you might need a 12 month undated budget planner. Here are a few:

- To get your finances under control. A budget planner can help you track your spending and see where your money is going. This can help you identify areas where you can cut back or save more money.

- To set financial goals. A budget planner can help you set financial goals and track your progress towards them. This can help you stay motivated and on track to reach your financial goals.

- To make better financial decisions. A budget planner can help you make better financial decisions by giving you a clear picture of your financial situation. This can help you avoid impulse purchases and make informed decisions about your money.

What to look for in a 12 month undated budget planner

When choosing a 12 month undated budget planner, there are a few things you should keep in mind:

- The features you need. Some budget planners come with more features than others. Consider what features are important to you, such as the ability to track your income and expenses, set financial goals, and create budgets.

- The format. Budget planners come in a variety of formats, including books, apps, and online tools. Choose a format that you are comfortable with and that you will use regularly.

- The price. Budget planners can range in price from free to several hundred dollars. Choose a budget planner that fits your budget.

How to use a 12 month undated budget planner

Once you have chosen a 12 month undated budget planner, it’s time to start using it. Here are a few tips:

- Set up your budget. The first step is to set up your budget. This involves entering your income and expenses. You can also set financial goals, such as saving for a down payment on a house or retirement.

- Track your spending. Once you have set up your budget, you need to track your spending. This involves recording all of your income and expenses. You can do this manually or use a budgeting app or software.

- Review your budget regularly. It’s important to review your budget regularly to make sure that you are on track. This will help you identify areas where you can cut back or save more money.

Benefits of using a 12 month undated budget planner

There are many benefits to using a 12 month undated budget planner, including:

- Getting your finances under control. A budget planner can help you track your spending and see where your money is going. This can help you identify areas where you can cut back or save more money.

- Setting financial goals. A budget planner can help you set financial goals and track your progress towards them. This can help you stay motivated and on track to reach your financial goals.

- Making better financial decisions. A budget planner can help you make better financial decisions by giving you a clear picture of your financial situation. This can help you avoid impulse purchases and make informed decisions about your money.

Conclusion

A 12 month undated budget planner can be a valuable tool for getting your finances under control, setting financial goals, and making better financial decisions. If you are looking for a way to improve your financial situation, I encourage you to consider using a budget planner.

Author Profile

-

Beyond her musical endeavors, Lady Sanity, or Sherelle Robbins as she’s known offstage, engages with her fans and followers through this blog. Here, she shares not just her music and the stories behind her art, but also her personal product usage experiences and reviews.

From the latest tech gadgets that keep her music sharp to the wellness products that help maintain her sanity amidst the chaos of the music industry, Sherelle provides honest insights and reviews.

This blog is a window into the world of Lady Sanity. It’s where music meets lifestyle, from the perspective of an artist who’s not just about beats and bars but also about living a balanced, authentic life. Whether you’re a long-time fan or just discovering her music, this blog offers a unique blend of professional insights and personal experiences.

Latest entries

- December 23, 2023Film PhotographyC200 Film with ISO 200 35mm: My Experience Testing This Film

- December 23, 2023PuzzlesBiblical Jigsaw Puzzles for Adults: A Fun and Educational Way to Learn More About the Bible

- December 23, 2023Maintenance, Upkeep And RepairsProtector de Pantalla Anti Espia: I Tested 5 Top Products and This is the Best

- December 23, 2023ServewareCat Throwing Up Gravy Boat